Impact

CPG Economic Pulse: Q2 Report

What’s Temporary and What’s Here to Stay?

August 2021

Second-Quarter Look

At the start of the summer, COVID-19 may not have seemed like it was the past, but it didn’t feel like part of the future either. Today, as cases surge once again and masking requirements for even vaccinated Americans return, the feeling of pandemic in perpetuity is hard to shake.

The vaccination rate is improving, but not quickly enough to stop the march of the more contagious delta variant. The economic effects of the delta variant have not shown up in data yet. It’s the biggest variable in a sea of unknowns that make the economic future difficult to predict.

Governments, companies and individuals making family decisions are wrestling with the same questions. What about our current economic conditions will be lasting? What will fade as the pandemic recedes? And how do we make practical decisions for the future?

Key Takeaways

Demand jumped 8.7% in Q2 2021, proving there was no major drop off in the need for CPG products, despite rollout of vaccines and widespread reopening of the country.

Adding only 12,000 jobs in the quarter, CPG is facing a labor crisis — despite wage increases.

The cost of making essentials continues to go up, with record Producer Price Index readings month after month and supply chains struggling to catch up.

Demand Continues to Set Records — But Is the End in Sight?

With the vaccine more widely available and the country returning to a relative normal in the second quarter of 2021, the natural assumption was that the incredible demand for CPG products at home would slow as Americans began venturing out more. In reality, CPG products continued their elevated pace with year-over-year growth of 8.7% in the second quarter.

It is the first year-over-year comparison that looks at quarterly results entirely during the pandemic, though at very different moments.

The ongoing demand is more remarkable considering it is compared to the early months of COVID-19, when anxiety was high and stocking up on essentials was prevalent. The second quarter of 2021 tells a different story. The CPG numbers reflect the optimism of reopening, with purchases of personal care products up 20.6% over the prior year. Items for foodservice — like popcorn at the movies or hot dogs at the ballpark — that suffered early in the pandemic have likely seen increases as events return.

But that second quarter optimism had yet to experience the delta variant. Delta’s influence will be reflected in the third quarter numbers, showing just how much the variant has hampered reopening efforts — and how demand for CPG products changes. A Consumer Brands/Ipsos poll of 1,000 American adults conducted August 6-8 found that 35% of Americans say they are spending more time at home because of the delta variant. Most Americans (63%) are spending the same amount of time at home, and only 3% say they are spending less time.

- 11/18

- 12/18

- 1/19

- 2/19

- 3/19

- 4/19

- 5/19

- 6/19

- 7/19

- 8/19

- 9/19

- 10/19

- 11/19

- 12/19

- 1/20

- 2/20

- 3/20

- 4/20

- 5/20

- 6/20

- 7/20

- 8/20

- 9/20

- 10/20

- 11/20

- 12/20

- 1/21

- 2/21

- 3/21

- 4/21

- 5/21

- 6/21

- CPG Pre Pandemic

- 1385191

- 1359067

- 1388598

- 1366984

- 1386101

- 1395086

- 1396706

- 1407028

- 1418769

- 1420449

- 1410140

- 1415189

- 1415799

- 1419266

- 1423273

- 1425151

- CPG Mid-Pandemic

- 1425151

- 1685242

- 1488862

- 1551673

- 1561922

- 1576916

- 1560810

- 1571042

- 1567966

- 1569809

- 1535240

- 1636059

- 1593282

- 1684543

- 1674707

- 1657491

- 1672136

- Long-Term Trendline

- 1384951

- 1387899.32

- 1390847.64

- 1393795.96

- 1396744.28

- 1399692.6

- 1402640.92

- 1405589.24

- 1408537.56

- 1411485.88

- 1414434.2

- 1417382.52

- 1420330.84

- 1423279.16

- 1426227.48

- 1429175.8

- 1432124.12

- 1435072.44

- 1438020.76

- 1440969.08

- 1443917.4

- 1446865.72

- 1449814.04

- 1452762.36

- 1455710.68

- 1458659

- 1461607.32

- 1464555.64

- 1467503.96

- 1470452.28

- 1473400.6

- 1476348.92

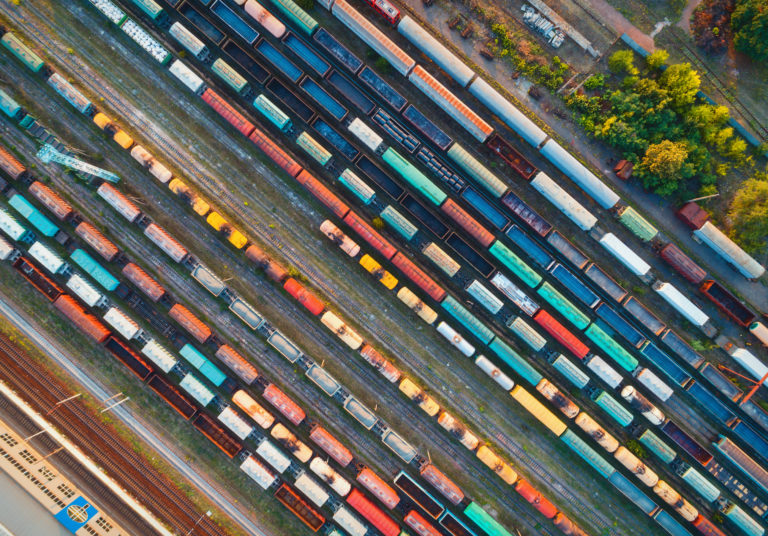

Rising Costs as the Supply Chain Is Tested

At-home consumption has been the biggest driver of CPG demand and will continue to put pressure on the industry at a time where the supply chain is at its breaking point.

Overall consumer spending has returned to pre-pandemic levels. The economy grew at an annual rate of 6.5% in the second quarter. That growth, however, was below economists’ predictions of around 8%. The space between prediction and reality is not a product of consumers tightening their belts in anticipation of a rough road ahead or further pandemic-related restrictions. Economic growth has been constrained by supply chain backlogs.

Every link in the supply chain is costing more right now. Month after month, the Producer Price Index sets a new record. On a year-over-year basis, PPI rose 6.1% in April, 6.5% in May and 7.1% in June, its inexorable march upward making it drastically more expensive to make essentials. Some of the most common ingredients in an array of CPG products have spiked in the last year. Corn, used in everything from tortilla chips to baked goods, is up 121%. Ethyl alcohol, used in cleaning products and hand sanitizer, is up 103%. Aluminum, used to package vegetables and soda, is up 100%. The list goes on and the story is the same.

There are also significant delays or added costs in shipping, both to get ingredients and materials to make products and to send finished products to consumers. Port congestion has reached unheard of highs recently, as ships struggle to deliver cargo. The trucking industry continues to struggle to find drivers needed to meet demand while combating dramatically higher diesel fuel prices. These bottlenecks lead to delays — bothersome when a consumer must wait months for furniture delivery, disastrous if those delays mean consumers don’t have access to essentials they depend on like baby formula, soap or toilet paper.

Consumer Brands continues to advocate for policies that end the government’s uncoordinated and outdated approach to supply chain policy and lets some steam out of the over-heating engine. Deliver America: A Platform to Restore Supply Chain Competitiveness and Resiliency outlines a national strategy for clear federal leadership, coordinated government action and forward-looking public policy that includes recommendations to reduce port congestion and grow transportation capacity.

Congress is increasingly recognizing the importance of the supply chain, as evidenced by the infrastructure package that passed recently in the Senate and now awaits a vote in the House. Included in the bill are many key provisions that will reduce long-term friction in the supply chain, like policy options to improve the national freight system.

- 1/19

- 2/19

- 3/19

- 4/19

- 5/19

- 6/19

- 7/19

- 8/19

- 9/19

- 10/19

- 11/19

- 12/19

- 1/20

- 2/20

- 3/20

- 4/20

- 5/20

- 6/20

- 7/20

- 8/20

- 9/20

- 10/20

- 11/20

- 12/20

- 1/21

- 2/21

- 3/21

- 4/21

- 5/21

- 6/21

- 7/21

- Producer Price Index for Final Demand

- 117

- 117.3

- 117.7

- 118.3

- 118.4

- 118.3

- 118.5

- 118.6

- 118.3

- 118.7

- 118.5

- 118.8

- 119.2

- 118.6

- 118

- 116.7

- 117.2

- 117.6

- 118.2

- 118.4

- 118.7

- 119.4

- 119.4

- 119.8

- 121.2

- 122

- 123

- 123.8

- 124.8

- 126.0

- 127.3

Job Growth Obscures Labor Crisis

U.S. employers made progress on job creation, attracting 850,000 workers in June — the largest increase since August 2020.

CPG is the largest manufacturing employer. There are 826,000 openings in manufacturing; 362,000 of which are in non-durable manufacturing where CPG jobs are recorded.

But the gains seen in the broader economy are not reflected in the CPG industry. In the second quarter, only 12,000 jobs were added — including the month of June where the growth was flat.

The limited growth is made more stark when stacked against current workforce needs. The CPG industry is the largest manufacturing employer and, according to BLS, there are 826,000 openings in manufacturing right now. Of those, 362,000 are in non-durable manufacturing, where CPG industry openings are recorded.

There has been significant growth in wages that has not resulted in similar growth in the workforce. Food manufacturing wages were up 4.6% in July over last year. For those in production and non-supervisory roles — which includes many of the essential workers in CPG manufacturing facilities — the jump was even higher at 6%.

In addition to raising pay, CPG companies are also looking to raise skills to meet their workforce needs. Consumer Brands recently called on government leaders to launch new workforce initiatives to advance education, apprenticeships and support of skilled trades and supply chain professions greatly in need of new talent. It also asked for legislation to support education tax credits, public-private job initiatives and targeted visa reforms to secure the next generation of talent.

In the near term, workers sidelined by family care needs throughout the pandemic may reenter the workforce as schools reopen. Consumer Brands supports enhancing childcare and family support programs and ensure schools have what they need to open fully.

The big variable for the available workforce will be the path of the delta variant and growth in vaccination rate. Now that the FDA has granted full approval of COVID-19 vaccines, the expectations around vaccination are likely to change quickly.

A Consumer Brands survey of 39 CPG companies, conducted July 28 – August 3, suggests the ground is already softening. Currently, 91% of companies said they were not requiring vaccination for any of their employees; however, in light of the delta variant, 66% said they were actively considering it or had not ruled it out.

The pandemic has created unpredictable and shadowy economic conditions. The delta variant and unvaccinated population are further curveballs making for an uncertain future. As the second half of the year progresses, questions over demand, costs and workforce will persist.

- Q1 2020

- Q2 2020

- Q3 2020

- Q4 2020

- Q1 2021

- Q2 2021

- CPG Employment

- 100

- 94

- 97

- 98

- 98

- 99

- Total Non-Farm Employment

- 100

- 88

- 93

- 94

- 94

- 95

How We’re Looking Ahead

The three biggest watchouts for the third quarter and the future of the CPG economy:

1. Will the delta variant keep Americans home more, leading to even higher demand on an already-stressed CPG industry?

2. Will the job gains in the broader economy start to be seen in the CPG industry?

3. When will the pressure release on a strained supply chain?

About This Research

Consumer Brands’ CPG Economic Pulse analyzes the totality of the industry — food, beverage, household and personal care products — to offer a timely look at an industry that contributes $2 trillion to the U.S. economy and supports more than 20 million jobs.

The data in this report is released on a rolling calendar schedule. The figures presented are current at the time of publication and are subject to updates and revisions.

Methodology

Economic analysis provided by JEK Analytics.

The CPG purchases data is derived from U.S. Bureau of Economic Analysis reporting.

Estimates include food, nonalcoholic and alcoholic beverages for off-premises consumption; food purchased and consumed on farms; nonprescription drugs, household supplies and personal care purchases; and net purchase of goods by U.S. residents abroad.

The Consumer Brands/Ipsos poll of 1,000 American adults was conducted August 6-8. The Consumer Brands survey of 39 CPG companies, was conducted July 28 – August 3.

The Economic Contributions of CPG

The CPG industry is the largest manufacturing employer in the United States. The food, beverage, household and personal care products that the industry makes have a positive impact on the lives of every American, every day.

Our Updates, Delivered to You

Receive the latest updates from the Consumer Brands Association.