Blog

What Heat, Rain (and Lack of Rain) Have to Do with Your Grocery Bill

For a wider lens on inflation and its causes, check out our Inflation Explainer. Here, we are looking at the individual factors that will continue to influence CPG products’ pricing.

A clearer picture is starting to come into focus of the toll extreme weather events are taking on the price to manufacture consumer goods. Climate change has ushered in extreme heat and drought, floods, blizzards and wildfires that quickly choke up the supply chain as workers cannot access or use the affected areas and crop yields are diminished or destroyed.

Decreased availability of ingredients and materials means increased costs to make and ship products to meet ever-rising consumer demand, resulting in higher prices.

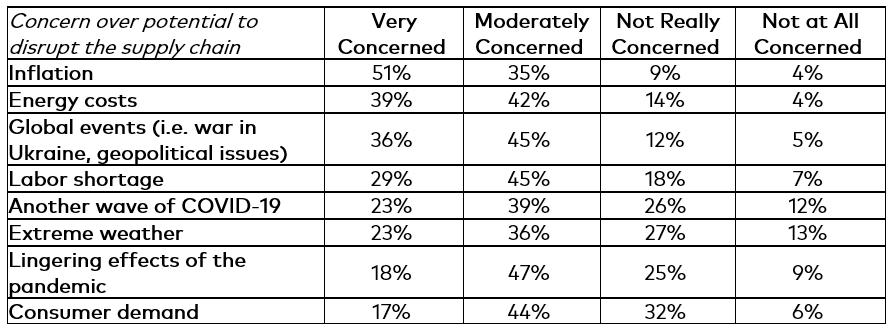

A new survey from Consumer Brands asked Americans to rank their anxiety over factors that contribute to supply chain slowdowns and, ultimately, inflation. More than half said they were either very concerned (23%) or moderately concerned (36%) that extreme weather will disrupt the supply chain. However, people reported being far more concerned about factors often set in motion by extreme weather events: nearly nine-in-10 respondents said they were very concerned (51%) or moderately concerned (35%) about inflation disruption the supply chain, while 81% of those surveyed said they were very concerned (39%) or moderately concerned (42%) about energy costs could disrupt the supply chain.

Tracking some of the commodities most integral to the industry has revealed a steep spike among costs of edible oils, eggs and diesel, to name a few. And then there’s wheat, which might offer the most current and troubling insight into the impact of extreme weather on commodities. Wheat was up 22% in July from the year prior, which was nearly welcome relief from the 64% increase in prices between June 2021 and 2022. The foundational ingredient has been absolutely hammered by record-shattering heat around the world. Kansas is one of the main producers of wheat in the U.S., but drought has decreased its crop 30% year-over-year, with a similarly grim outlook in Oklahoma and Nebraska.

It isn’t only weather affecting the wheat market. Russia’s invasion of Ukraine took nearly a quarter of the world’s wheat off the market overnight. Countries reliant on those exports scrambled trying to find alternatives. At one point, India — the world’s second largest wheat producer behind China — indicated it could solve for the shortfall, yet only weeks later reversed course and placed on a ban on wheat exports. Why? Extreme heat hurt crop yields and India needed to ensure it had enough supply domestically to feed its people.

Relief doesn’t seem to be in sight for the region as summer comes to a close: China has been pushing through its own unprecedented heatwave and rang the alarm in August that its crops could face a major downturn come fall. In Europe, temperatures are pushing agriculture to its limits as well: the Italian farmer’s association told The New York Times drought could impact their wheat yields by as much as 15%.

More shortages at the grocery store could be imminent. In California, a historic drought has left tomato growers “desperate” as they grapple with meeting consumer demand for processed tomato products like spaghetti sauce.

Extreme weather is also laying bare the gaps in America’s infrastructure, which means even if crops can get harvested and loaded on trucks for delivery, that’s not the end of the (literal and figurative) roadblocks to getting it on shelves.

This concern is likely to keep climbing the ranks among Americans’ worries for the supply chain as extreme weather events only worsen. According to a new report from OnSolve, an AI-based risk assessment and crisis management platform, extreme weather events increased by 47% globally between 2020 and 2021. In the U.S. alone, wildfires jumped 74% and severe storms were up 63%. Winter storms increased by a whopping 203% year-over-year. The federal government estimated that the total cost of extreme weather events in 2021 topped $145 billion, with Hurricane Ida, February’s winter storms and Western wildfires each accruing the costliest damages.

Stark as those numbers are, consider the context provided by climate experts who spoke to The New York Times and rebuffed the idea that the dramatic increase in weather events is some kind of “new normal” when we have yet to see the worst of it.

Extreme weather is another stressor on the supply chain that exposes the critical need for passage of common-sense legislation to mitigate friction and ensure a safety net when uncontrollable events upend daily life. In guaranteeing greater visibility into what we know and can control, we can better adapt to events that are harder to predict.

Published on September 7, 2022