Blog

Circana: A Cautiously Optimistic 2024 Outlook for Consumer Packaged Goods Companies

As consumer packaged goods companies begin the new year, they face a combination of tailwinds and headwinds that, viewed holistically, foretell a great opportunity for unit growth in 2024.

Coming off a pandemic and high inflation, the picture still isn’t entirely rosy. CPG prices are 30% higher than they were in 2019 and consumers continue to be hampered by rising credit debt and high housing costs. At the same time, we’re seeing significant tailwinds: A strong labor market, cooling inflation, improving consumer sentiment and an uptick in Social Security and Supplemental Security Income benefits.

But these macro trends aren’t affecting all consumers equally — and that has significant implications for consumer packaged goods companies. We are seeing a real savings bifurcation right now. Lower income consumers have depleted a large portion of their excess savings, while the remaining $1.3 trillion in excess savings is held predominantly by the 55+ age segment and the top 20% of income earners.

In this environment, all consumers are interested in saving money, but how they’re doing it is varied. Higher income consumers are seeking bulk value, while cash-strapped lower income shoppers are buying just in time at entry-level price points and making fewer trips to stock up.

Changes in consumer behavior are currently characterized more by channel shifts than by brand migration — and especially toward the pure-play e-commerce and club channels for nonfood items. While shoppers are seeking value, we are seeing weaker promotional returns across food and beverage and nonedible products. This is partly because promotional prices don’t feel like a value to shoppers compared to the pre-pandemic reference prices they still remember.

We’re also seeing CPG categories such as food and beverage, pet, home care and healthcare outperform more discretionary spend areas, with do-it-yourself categories also on the rise. At the same time, premium products are still in demand in CPG, but consumers are more discerning about where and when they splurge.

In fact, the super-premium tier gained share over mainstream and value tiers throughout 2023. In some cases, super-premium products enable consumers to bring the out-of-home experience into the home. In the food space, they also provide value compared to eating out, since the food cost per eating occasion of commercial foodservice remained 4.2 times the cost of foods eaten at home and sourced from retail in the 12 months ending June 2023.

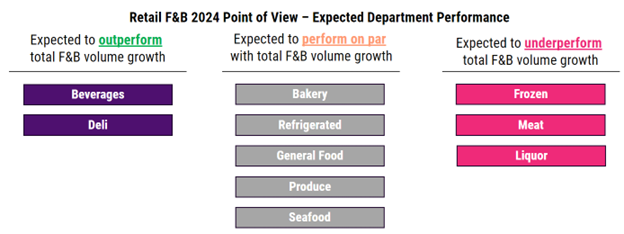

While declining inflation may cause food and beverage dollar sales growth to moderate in 2024, the new year is likely to bring volume growth to the grocery channel for the first time in three years, as long as the labor market remains strong. We do, however, expect performance to vary by category.

- Focus on value messaging across price tiers;

- Monitor promotions closely to ensure optimal lifts and margins;

- Innovate out-of-home experiences for in-home;

- Offer assortment variety for different consumer targets across all price tiers; and

- Leverage social media to excite and inspire.

With cautious optimism warranted and results far from guaranteed, one thing is certain: These approaches will help you make the most of the year ahead, whatever the future holds.

Sally Lyons Wyatt is the Global EVP & Chief Advisor, Consumer Goods & Foodservice Insights at Circana.

Published on February 15, 2024

Our Updates, Delivered to You

Receive the latest updates from the Consumer Brands Association.