Report

COVID-19 Polling: Fall Look-Ahead

Expectations Change as the Pandemic Enters a New Season

The Consumer Brands Association’s latest COVID-19 poll asked 1,308 American adults about their opinions on the coronavirus and its effect on the country. The data shows a country normalized by a persistent threat, but also contending with growing anxiety over what’s ahead. Fall will bring several new factors to the fore — including cooler temperatures, a looming flu season, a murky economic forecast and a pivotal election. What factors will have the greatest impact on American life, however, is an open question.

Shortages or not, concerns over access to CPG products persist.

While the supply chain has largely solved for shortages of high-demand products like toilet paper, meat and cleaning supplies brought on by panic-buying early in the pandemic, Americans’ fears over access to those products has not.

The Consumer Brands’ survey began as a weekly look at American sentiment around COVID-19 and then increased the time between surveys; however, there is a clear story in the data that shows access concerns to every product type — food and beverage, household cleaning, personal care and over-the-counter medicines — have been ticking up since hitting a low point in the summer. Over-the-counter medicines, specifically, hit its highest point of concern yet in the latest survey, with 66% reporting fears over access to those products. Cleaning products matched the April 15 survey high of 74% concerned about access.

- March 11

- March 18

- March 25

- April 1

- April 8

- April 15

- April 22

- May 6

- June 3

- June 29

- July 27

- September 16

- Access to Household Cleaning Products

- 54

- 68

- 67

- 71

- 72

- 74

- 70

- 68

- 68

- 69

- 72

- 74

- Access to Personal Care Products

- 56

- 70

- 63

- 62

- 62

- 61

- 59

- 56

- 60

- 59

- 59

- 64

- Access to Food and Beverages

- 62

- 77

- 72

- 71

- 65

- 64

- 61

- 63

- 64

- 62

- 63

- 69

- Access to Over-the-Counter Medicines

- 58

- 64

- 62

- 60

- 58

- 56

- 56

- 56

- 58

- 56

- 59

- 66

Americans are finding their way forward and changing the way they live and shop.

As the pandemic drags on, across the country, people are slowly resuming routines. When first asked in late June, 32% said they had only considered returning to their normal routine or wouldn’t consider returning to normal until a vaccine or treatment was available. Today, that number stands at 25%. The most frequent answer from respondents was that they were resuming their normal routine with a mask or other protective gear (29%).

The slow return to routine may face further challenges, as the vast majority of Americans anticipate a spike in COVID-19 cases when the weather cools down in the fall and winter. Couple that anticipation with anxiety over people not wearing masks in public places — something 77% of Americans are concerned about — and the coming months can be expected to challenge the country further.

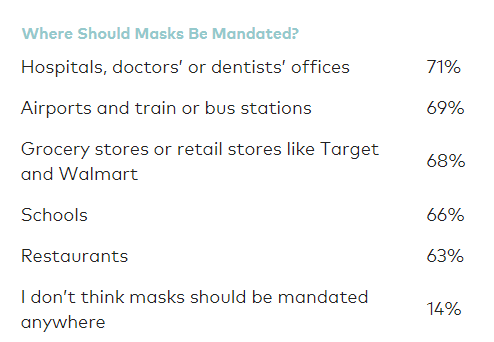

Mask mandates are supported by a majority of Americans in many places. Grocery stores and retail locations like Target and Walmart are toward the top of the list, with nearly seven-in-ten (68%) respondents believing they should be mandated there, behind only hospitals and medical offices (71%) and airports, train and bus stations (69%).

There is, however, a distinct difference in political affiliation on whether or not a mask is necessary. More than a quarter (26%) of right-leaning respondents do not believe masks should be mandated anywhere, compared to only six percent of left-leaning respondents.

The high degree of concern on mask-wearing in the grocery store may contribute to the changed shopping habits of many Americans. While the majority (73%) go to the grocery store themselves and 15% say someone else in their household does the shopping, 12% of Americans have moved to ordering grocery products online for delivery or store pickup. While far from mainstream, those who have moved to online grocery shopping intend to continue it after the pandemic is over. Sixty-four percent of new online grocery shoppers say they will “absolutely” or “likely” continue to do so after COVID-19, added to the nine percent who said they were already using online ordering and would also continue. Only 14% said they would stop using it after the pandemic and 13% said they weren’t sure.

About this Survey

Consumer Brands Association conducted a survey of 1,308 American adults (18+) from September 16-21, powered by Toluna.

Coronavirus Information Center

From providing original research, industry guidance and cutting-edge insights, we’re committed to giving our industry what it needs so it can focus on what matters most — providing essential goods for consumers in crisis.