REPORT

Election Pulse: A CPG Look at the Issues Driving Voters

October 2022

As the 118th Congress gets set to convene — with 84 new members arriving in Washington — many of the biggest issues on Americans’ minds are concerns shared across the consumer packaged goods industry. A new Consumer Brands/Ipsos survey analyzed voter attitudes about key issues impacting the essential products they depend on every day — food, beverages, personal care and cleaning products.

This data offers a closer look at voters’ motivations, behavior and expectations through the lens of the consumer packaged goods industry. And, notably, gives a sense of what both voters and the CPG industry want lawmakers to have top-of-mind to best serve their constituents when the new session begins in January.

#1: INFLATION

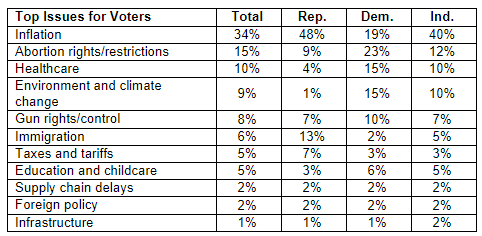

Inflation remains voters’ number one concern. Inflation outranks other top three issues — abortion and healthcare — by a large margin.

It’s a concern shared by CPG companies. The cost to produce CPG items has risen dramatically for the last year and a half, and the ripple effect has led to increased prices for consumers — a challenge that will have a major impact at the polls. The average American uses 42 CPG products every single day, and they are difficult, if not impossible, to trim from household budgets.

Other key contributors to inflation – supply chain and infrastructure – are also priorities for voters, although not as highly ranked. These issues directly impact the cost to make CPG products and, ultimately, the prices consumers pay. Supply chain delays, for example, have been a major contributor to rising costs.

#2: Packaging Sustainability

Environment and sustainability issues continue to worry voters. For the CPG industry, progress on sustainability is a top priority, impacting both supply chain and the need to increase recycling rates.

Climate change has spurred droughts and other weather events, creating a more profound impact than ever on the ingredients and materials required to make products that Americans depend on every day. Moreover, voter confusion about the patchwork of recycling rules and jurisdictions shines a light on a broken system that demands standardization to be fixed. Vot

The survey shows not only that voters care about the environment but that they are frustrated that efforts to reduce the amount of waste sent to landfills across the country are hampered by a recycling system that continues to see an inexorable decline.

#3: Voters

Voters are running out of patience. What affects the CPG industry has consequences that have shown up more visibly for voters since the start of the pandemic.

With acute awareness of what policymaker inaction can mean in terms of access to products they need, candidates should expect it to have bearing on who voters choose and what they expect accomplished — not necessarily how it gets done. It is the responsibility of elected officials to develop an agenda that meets voter expectations and understand what needs to be done to make it happen. If inflation is voters’ top concern, it is up to policymakers to understand its drivers and how to curb its rise. They must appreciate the impact of supply chain delays, infrastructure, the environment and other factors on the cost and availability of ingredients, materials and finished goods.

The following findings offer a look at how voters are thinking about today’s biggest issues and present the CPG perspective on how elected officials should tackle some of the biggest challenges shared by companies and consumers alike.

How Voters are Managing Inflation

To deal with ongoing inflation, Americans are making choices. Many are forgoing large purchases like a new home or car, driving less or putting off a vacation, and some are finding ways to decrease their grocery budget.

According to the survey, 44% of voters have made cuts to their household budgets by buying fewer groceries or switching to less expensive options, with the number higher (55%) among those with an annual household income under $50,000. That doesn’t necessarily mean people are buying less overall but does point to how they are shopping for groceries and personal care items. More than half of respondents (54%) said they are mitigating the impact of inflation on their households by forgoing extra items or limiting impulse buys, with the numbers largely consistent among Republicans (55%), Democrats (51%) and independents (57%). Coming in a close second, 47% are choosing less expensive brands or store brands while 33% are buying fewer groceries overall — including 44% among voters in the lowest income range.

Despite consumers cutting back, September was the 13th month in which demand outpaced the panic buying of March 2020 that sent sales soaring and offered further evidence of a new, permanent change in consumer behavior. That change is up against a challenging inflationary environment — for both businesses and their customers.

Inflation Blame Game

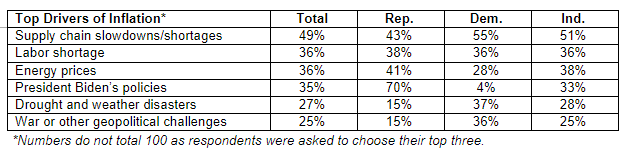

Rising consumer prices are the inevitable outcome of soaring costs to manufacture and ship goods, which has been driven by a host of factors, and the survey’s data shows voters are aware of the many contributors to inflation for everyday goods. When asked to choose what they consider to be the top three drivers of grocery inflation, the supply chain was clearly the top choice but almost every option was cited by a healthy percentage of respondents.

Nearly half (49%) of voters hold supply chain shortages and slowdowns responsible for inflation. The ranking reflects perceptions shifting away from placing blame squarely on the pandemic, with voters saying that energy prices (36%), the administration’s policies (35%) and weather wreaking havoc on critical ingredients (27%) are behind the cost of goods going up. This evolution became clear in June, when polling data revealed the pandemic had dropped below other concerns, paving the way for the supply chain to take center stage.

In many ways, every response is correct. Energy prices — specifically diesel fuel — have hit CPG companies particularly hard since the industry accounts for one-fifth of all U.S. freight transportation. Weather, particularly drought, has constricted supplies of critical ingredients like wheat and oats. War and geopolitical challenges are also tightening the availability of ingredients like edible oils used to manufacture food products. The 75% of the global sunflower oil market held by Russia and Ukraine was upended by Russia’s invasion of Ukraine, while the palm oil market has been affected by an export ban in Indonesia, which products 59% of that commodity.

On the personal care side, the raw materials needed to make tampons became harder to secure in the spring as customers noticed supplies dwindling across drugstores. And in perhaps the direst consumer goods shortage since toilet paper, baby formula largely disappeared from store shelves earlier this year, leaving parents and caregivers scrambling. The Food and Drug Administration has temporarily relaxed rules on both manufacturing and importation of formula, but the shortage sent consumers seeking leads on online forums as they hunted down formula on their own while waiting for federal help.

Consumers Most Concerned About CPG Product Availability

Rising costs signal a supply-and-demand imbalance. Price is one factor and availability another but scarcity can have a devastating impact when it comes to essential products. Stress on the supply chain continues to create bottlenecks and delays. While the pandemic exposed the supply chain’s inability to right itself without greater oversight, issues persist two years later, renewing concern among consumers who aren’t far enough removed from the despondency of frantically arriving at empty store shelves at the outset of the pandemic.

“Consumers understand the supply chain is stressed, but it doesn’t excuse a product they rely on running short,” Consumer Brands Vice President of Supply Chain Tom Madrecki said. “There is greater patience for out-of-stock exercise equipment or video games than there is for toothpaste and baby food.”

To that end, the survey found Americans are more concerned about the availability of daily essentials like food, beverages, cleaning products and personal care products than any other category. The survey found that 72% said availability of groceries is more important than furniture, 65% said the same about electronics, phones and appliances and another 62% ranked them as more important than cars.

Biggest Supply Chain Risk is Inaction

The pandemic is not the only cause of America’s supply chain problems. In fact, it revealed many ongoing and underlying supply chain issues ranging from geopolitical risks to weather events that surface each time there is a disruption and need to be addressed.

Over the past year, extreme heat, droughts and flooding have dramatically impacted crop yields around the globe, causing shortages of tomatoes, olives and wheat, to name a few. In the United States alone, wheat yield dropped 30% in Kansas, where a majority of the domestic crop is produced, with similarly grim results in nearby states. A case study from global management consulting firm McKinsey & Company published in August 2020 broke down how climate could deteriorate an unprotected and unprepared supply chain over time, noting that “the more commoditized the supply chain is, the larger number of downstream players that may be affected by spiking prices from a sudden reduction in supply.” A report from the Yale School of the Environment put the problem into perspective by noting that “the pandemic is a ‘temporary problem’ while climate change is ‘long-term dire.’”

The critical nature of well-functioning supply chains has been made painstakingly clear in the last two years, leading voters to appreciate the need to act on solutions to shore up supply chain fundamentals. A majority of voters polled (57%) think the federal government should invest in technologies to spot issues in the supply chain before they become crises or shortages, and 55% said supply chain fixes should be a priority for Congress. Further, 57% said they’re more likely to vote for a candidate who believes inflation will be lessened by addressing supply chain challenges for the products they rely on daily.

“The biggest risk to the supply chain is our own inaction.”

“The biggest risk to the supply chain is our own inaction,” Madrecki said. “To paint supply chain challenges as a pandemic problem is to misunderstand the whole picture. Companies are doing what they can to build resiliency, but government can’t walk away from its unique role if we want to solve these challenges for the long-term.”

In July, Congress failed to adopt critical supply chain provisions that were cut from legislation intended to increase U.S. competitiveness with China. Elements removed during House-Senate negotiations over a final version of the bill had the potential to create visibility and resiliency in the supply chain and Consumer Brands has called for them to be taken up as a separate measure.

“The worst thing we can do is proclaim the crisis over as the pandemic recedes,” Madrecki said. “The next one lurks around every corner, and we cannot afford to fail.”

Bridging the Political Divide

One area of critical alignment on the environment is reducing plastic and packaging waste. While sentiment is higher among Democrats (84%) than Republicans (64%), Americans on both sides of the aisle (75% overall) want to buy products that come in packaging that can be recycled. There is also a strong preference for packaging made from material that has already been recycled (75% overall, 82% of Democrats and 66% of Republicans).

Democrats (80%) and Republicans (59%) surveyed said recycling is a top priority because it reduces the environmental footprint of plastics and packaging — but also believe recycling rules need to be easy to follow. Unfortunately, the words “easy” and “recycling” don’t always go together in the U.S. system. With recycling governed by state, county or municipal rules, everything from the material a package is made of to where someone lives — even what month it is — can determine whether packaging can be put into a recycling bin. According to the Environmental Protection Agency, there are more than 9,800 recycling systems across the United States. And each has its own unique set of rules.

The vast majority (72%) of survey respondents said rules for what is recyclable should be the same across the country, including 83% of Democrats and 64% of Republicans.

“The desire to reduce the environmental impact of packaging is a shared goal for CPG manufacturers and Americans, regardless of party affiliation,” Consumer Brands Vice President of Packaging Sustainability John Hewitt said. “Elected officials can complement industry efforts to design more sustainable packaging by enacting smart policy that simplifies a failing system — and that starts with cleaning up the mess of rules that have contributed to confusion and contamination that has left recycling on the brink.”

Decades of allowing Americans to defer to their interpretations and assumptions is not the only problem undermining recycling efforts. The shifting dynamics of the global economy are changing the viability of recycling systems from coast to coast, leading many communities to send recycled material to landfills — or to scrap recycling programs altogether.

The Economics of Recycling Have Changed — Recycling Has to Change With It

It wasn’t long ago that a used plastic bottle usually made its way to China. Since 1992, China has imported nearly half (45%) of the world’s plastic waste. But China’s economy has changed, and so has its appetite for foreign waste. At the start of 2018, the country’s “National Sword” policy went into effect, limiting contaminants in recycled material it will accept to no more than 0.5% — a target too strict to reasonably achieve given that consumers often fail to properly rinse bottles or try to recycle things like grease-covered pizza boxes. Exports of recyclables to China plunged more than 90% after the policy went into effect.

Since then, local recycling systems across the United States — many of which previously sent the recyclables they collected to China — have struggled to stay in operation as they have moved from making a profit to being a cost center. The National League of Cities found that 64% of recyclables offered a reasonable return in 2017. By 2018, that number dropped to 35% as the price received for a typical ton of plastic and mixed paper fell by half.

The stark reality of recycling in the United States today does not align with how Americans view their individual actions. Despite a declining national recycling rate, 48% of those surveyed said they are recycling the same amount as five years ago and 33% said they’re recycling more.

After jumping dramatically in the 1990s and early 2000s, the United States’ national recycling rate hit a peak of 35% from 2015 through 2017. From there it dropped to 32% in 2018, the latest year for which data is available. For plastic, the number is even worse — only 8% is recycled.

It is not the consumer’s fault. The system is designed to fail. With 9,800 localities operating their own programs with their own rules, the patchwork invites confusion and contamination.

Recycling Beliefs vs. Reality

Recycling in America is full of contradictions, as were the survey results. More than eight-in-10 respondents (83%) reported being confident that they know the recycling rules where they live. Yet 84% said any package that has the Universal Recycling Symbol can be put into their curbside bins. That can be true some places but is not guaranteed everywhere — because with nearly 10,000 recycling systems there are nearly 10,000 answers.

For example, take an egg carton. In California, a standard plastic egg carton can be recycled in Stockton and Altadena, but can’t in Burbank and El Monte, and it’s unclear in Compton and Hughson. That’s only a glimpse at the complexity of just one state. The question is repeated across 50 states and every county or municipality within them.

Even within a single recycling system there can be further fragmentation. In Fairfax County, Va., for example, there are 13 private companies that handle residential pickup in addition to the county itself, which collects from only about 10% of residents. To determine what can be recycled, the county can only offer general guidelines, telling residents with private collection to ask the company for specifics. That leaves 14 possibilities within one county.

Confusing System Discourages Participation

Seven-in-10 Americans surveyed (70%) said having nearly 10,000 sets of rules is hurting recycling rates. And 55% find all the different recycling rules confusing.

“The commitment is there; the policy isn’t.”

Even though most Americans say they are recycling as much as or more than five years ago, 51% said they would be more likely to recycle if there were a single set of clear rules.

“There is no doubt that confusion is contributing to contamination and driving down our recycling rate,” Hewitt said. “There is also no doubt that standardized recycling rules will help us stop talking in circles and start solving the problem.”

The Clear Case for Standards

Voters do not necessarily have a clear point of view on who should be responsible for setting recycling rules — but they clearly believe streamlined rules should be set.

A majority (58%) would prefer to see a federal standard while just 39% want their state to have the ability to set its own rules. Most (75%) said it should be easier for recycling systems to raise rates, a view held by 81% of Democrats and 69% of Republicans.

A majority (58%) would prefer to see a federal standard while just 39% want their state to have the ability to set its own rules. Most (75%) said it should be easier for recycling systems to raise rates, a view held by 81% of Democrats and 69% of Republicans.

Across the survey, strong majorities were in favor of simpler, more uniform recycling policies. That common thread shows the common sense of American voters whether they are Democrats or Republicans — they do not need to be environmental or political experts to appreciate the value a simpler system could bring.

Uniform standards and definitions would allow packaging to be designed for greater recyclability. They would create the ability to measure and manage recycling to boost recovered material. They would enable better decisions on where to make infrastructure and technology improvements to recycling facilities. They would provide for consistent and broad consumer education that would reduce contamination. And, perhaps most importantly, they would help determine where to target funding to ensure that money has the most meaningful impact — an impact that CPG companies are willing and ready to invest in.

“The commitment is there; the policy isn’t,” Hewitt said. “That’s where we need the attention of Congress in January.”

About

Contributors

Learn more about the thought leaders at Consumer Brands who contributed to this report.

John Hewitt

Vice President, Packaging Sustainability and Head of State Affairs, Consumer Brands Association

Methodology

This Consumer Brands/Ipsos poll was conducted September 27 – October 6, 2022, by Ipsos’ KnowledgePanel® – the largest and most established online panel that is representative of the adult U.S. population. The poll is based on a nationally representative probability sample of 2,024 registered voters. The sample includes 603 Republicans, 705 Democrats and 592 Independents. The margin of error for the total sample is +/- 2.37 percentage points at the 95% confidence level.

Read More

Blog

SmartLabel Honored by Fast Company’s Innovation by Design Awards

Blog

Five Questions to Ask to Analyze Health Studies

Blog

Trading Down: Recent Trade and Tariff Decisions Hurt America’s Largest Manufacturing Sector

Our Updates, Delivered to You

Receive the latest updates from the Consumer Brands Association.