REPORT

CPG Outlook 2022

May 2022

How Emerging from COVID-19, Workforce Revolution and Climate Change Will Inform the Industry’s Future

After the volatility of 2020 and 2021, there was strong hope for stabilization in 2022. But as the pandemic hits the two-year mark with yet another variant and Russia’s invasion of Ukraine rattles the world, that hope has faded.

Consumer Brands expectations for 2022 shifted dramatically in the first quarter. First as omicron disrupted what we thought we knew about COVID-19 and then as Russia instigated a humanitarian crisis and global economic turmoil. Anxiety pervades each news cycle.

Less than one month into the second quarter of the year, the continued feeling of unease informs the trends we see emerging for the rest of the year. In 2022, optimism is cautious, pessimism is informed. With the caveat that conditions change quickly — as the last two years have proven — Consumer Brands has identified three trends that will shape the industry the remainder of the year.

#1: Inflation

More than a year of skyrocketing costs to make and ship products will be exacerbated by the Russian invasion of Ukraine furthering inflation and prolonging the supply chain crisis.

#2: Work Revolution

COVID-19 did more than upend work temporarily. It accelerated changes that will fundamentally reshape work and bring the future into the present ahead of schedule — for every collar color.

#3: Sustainability

Business commitments to sustainability in concert with dire warnings on climate change and investor pressure will accelerate environmental progress — but that progress will be mired if governments conflict or misunderstand the issues.

About

Meet the Experts

Learn more about the thought leaders at Consumer Brands who contributed to this report.

Joseph Aquilina

Vice President & Deputy General Counsel, Consumer Brands Association

#1: INFLATION

More than a year of skyrocketing costs to make and ship products will be exacerbated by the Russian invasion of Ukraine furthering inflation and prolonging the supply chain crisis.

Inflation has exceeded more than 40-year highs, prompting the Fed to raise interest rates for the first time since 2018 and announce intentions for further rate hikes throughout the year. The writing, however, has been on the wall for some time. Supply chain backlogs and record-setting wholesale costs that have persisted for more than a year signaled trouble well before consumer inflation took hold.

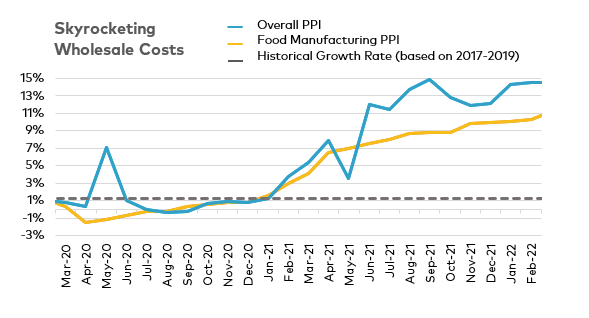

For CPG manufacturing, the cost of ingredients has outpaced overall wholesale prices significantly since last summer. Consumer Brands anticipates a decline in PPI in the coming months; however, that decline will still be well above historical norms. Taking into account the 2017-2019 average growth rate of 2.4% — the last pre-pandemic “normal” time — the forecasted decline for food manufacturing is only nominal and still anticipates wholesale costs will be 10.3% greater than 2021. In short, reduction may be the beginning of relief but is far from a bargain.

Input costs increases have not been one-size-fits-all. As demonstrated in the chart above, food manufacturers have been hit harder than overall wholesale buyers. Within ingredients, too, there are peaks of significance that have affected household staples in food, beverage, cleaning and personal care categories.

“The CPG industry has absorbed as many costs as it can and respects what rising prices on necessities means for family budgets,” said Freeman. “There is, however, a breaking point and price increases are now an unavoidable outcome.”

Poll: Top 3 Drivers of Grocery Inflation

| The pandemic | 30% |

| President Biden's policies | 27% |

| Supply chain costs and constraints | 21% |

CPG prices have risen 8.0% since last year, below overall consumer inflation of 8.5%. Despite trending lower than average inflation, nearly nine-in-ten (89%) consumers have noticed an increase in grocery prices recently. Consumers are also likely to feel prices have risen more than they have. A recent dunnhumby survey found that consumers estimated prices have risen almost 18%, far more than actuality but an indicator of how taxed Americans feel over inflation.

A Consumer Brands/Ipsos poll revealed that consumers place blame for their inflationary woes on the pandemic. It is a fair assessment, as the pandemic unleashed consequences that led to inflation, from supply chains thrown into chaos to consumers who had more money available to spend on goods.

Russia Exacerbates Inflation Expectations

Russia’s invasion of Ukraine has spawned a humanitarian crisis and created global economic turmoil. The latter will further challenge the cost to manufacture essential goods.

Energy prices are affecting consumers at the pump and having a broad-based impact on the cost of shipping raw ingredients and finished products. The CPG industry accounts for one-fifth of all freight, and the price of diesel will have a ripple effect across the supply chain.

Russia’s actions are ratcheting up the cost on commodities of importance to the CPG industry like wheat, sunflower oil, corn and rice. Russia and Ukraine supply about a quarter of the world’s wheat and when the war began, that market disappeared virtually overnight. While wheat for U.S. production is more likely to come from within the country, other countries that depend on Russia or Ukraine for wheat exports are scrambling to find other suppliers, driving demand — and global pricing pressure — up.

This new pricing pressure only exacerbates the challenging cost environment that U.S. companies have been contending with for the last year. Keep in mind, while wheat prices have jumped since the invasion of Ukraine, diesel was up 57%, wheat up 39% and fats and oils up 37% over last year prior to Russia initiating war.

The Supply Chain’s Effect on Inflation

Inflation did not start climbing up when Russia invaded Ukraine. In addition to Russia’s war, there are many drivers of inflation: early pandemic shutdowns of non-essential production constricting supply; government stimulus that led to increased consumer demand that funneled to goods not services; a labor shortage that has inhibited the supply chain’s ability to catch up with the backlog of demand. It is a list that could go on.

The frustration that comes with inflation is one the CPG industry understands. Like all industries and the consumers it serves, CPG companies have not been immune to inflationary pressures. Even as wholesale prices set another record last month, up 11.2% over last year, the picture for food manufacturing specifically was even bleaker, where input prices rose 14.6% in March. Specific commodities that are heavily used by the industry posted even more staggering increases: oats rose 98% over last year; edible oils jumped 46%; and aluminum spiked 44%.

“The volatility of today’s inflationary environment emphasizes the need to focus on meaningful solutions in our control,” said Tom Madrecki. “Limiting the impact of the next supply chain crisis starts with being able to spot it before it happens, but we have too many blind spots today. Reliable data could change all that, helping supply chains manage risk, unlock efficiency and enhance resiliency.”

The need for greater supply chain resilience has been made more urgent as new crises and disruptions emerge. Even beyond the pandemic, from weather disasters wiping out crop yields to the unpredictability of Russia to an unexpected ban on Indonesian palm oil exports, volatility has been a constant.

Where the pre-COVID supply chain was capable of handling individual disruptions, it now must be readied to take more frequent hits. Take, for example, Indonesia’s recent decision to ban palm oil exports. As Consumer Brands noted in its letter to the Department of State, Indonesia supplies 59% of the global palm oil market, and its effective absence will have a devastating effect, not only on prices but availability of an ingredient that goes into food, personal care and cleaning products. The consequences for developing nations that rely on palm oil for their diets could be even worse — and have geopolitical consequences. As the letter notes, “Coupled with soaring grain prices, you start seeing significant ramifications to basic meal and food costs, which are a historic trigger for unrest and political disruption. Stabilizing oil and commodity markets is a national and international security concern just as much as it is an economic one.”

While some consequences are easier to predict, today, there is alarmingly little visibility into the U.S. supply chain. Companies have only narrow windows to view their link in the chain, leaving massive blind spots that undercut the ability to build resiliency into the system.

“Limiting the impact of the next supply chain crisis starts with being able to spot it before it happens, but we have too many blind spots today.”

Consumer Brands has called for the creation of a federal office of supply chain to provide coordination across agencies and to oversee U.S. supply chain concerns. Under that office, the creation of a national freight data portal that could share real-time information could fundamentally transform how 21st century supply chains operate. This data has the potential to empower everything from expedited border clearances to ingredient traceability — and it is a Consumer Brands priority that the Biden-Harris administration just announced action on.

The existence of national freight data could serve as the foundation for “ground traffic control,” — a system akin to air traffic control — that could leverage data gleaned from supply chain stakeholders to create visibility that spots problems before they happen.

“These are moonshot ideas,” said Madrecki. “But COVID-19 showed the supply chain what it’s missing — shame on us if we don’t act on what we learned.”

The moment for change is ripe. There has never been such keen awareness of the supply chain — or its problems. Prior to the COVID-19 pandemic, Americans did not think about supply chain. Today, however, nearly seven-in-ten (68%) say they are giving it more thought.

They expect their elected officials to give it more thought too. The Consumer Brands/Ipsos poll found that 69% of Americans are concerned about supply chain challenges resulting in shortages and delays and another 68% said they want to see their government leaders take action on policy solutions to reduce supply chain pressure like increasing trucking capacity, growing the labor pool or expediting port clearances. On this issue, there is little party divide, as 74% of respondents who identify as Republican and 70% who identify as Democrat say the same.

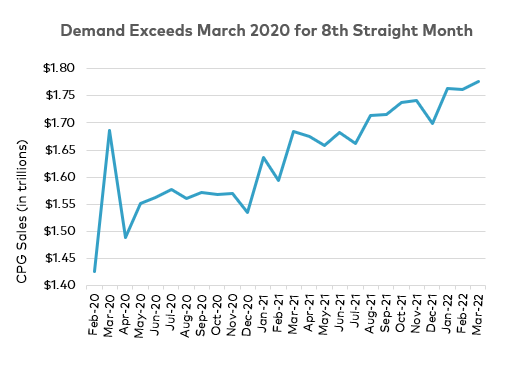

Demand to Remain High

Consumer demand for CPG products has exceeded March 2020’s shelf-clearing highs for the last eight months, most recently up 5.4% over last year. While consumer demand for some goods should slow down as supply catches up and rising interest rates have their intended cooling effect, demand for CPG products is unlikely to slow down the way Consumer Brands forecasted last year.

It is increasingly likely that what appeared to be elevated pandemic demand is instead the new normal. The pandemic reshaped American life in ways that will outlast it. More than 10% of respondents reported moving to a new home in the last two years, and another 7% say they moved to a new area entirely. Another 24% did a home renovation or addition. The changes have contributed to a significant number of Americans who want to spend time in their new or renovated homes and, as a result, consume more at than away from home.

In addition, 40% of Americans are working from home exclusively or at least a few days a week on an ongoing basis. That too will mean more at-home consumption continues beyond the pandemic.

It follows that the last eight months have seen CPG product sales that surpassed the shelf-clearing hysteria of March 2020. But recent months have not been panic-driven buying, they have been routine.

Consumer Brands expects some leveling and even some drop-off but does not anticipate demand levels returning to where they were before the pandemic. The incredible demand of the last two years is the new normal. And that new normal ups the ante for smart supply chain policy designed for a changed world.

#2: WORK REVOLUTION

COVID-19 did more than upend work temporarily. It accelerated changes that will fundamentally reshape work and bring the future into the present ahead of schedule — for every collar color.

Somewhere between planning to work from home for two weeks to two years of navigating daily life in a pandemic, revelatory shifts defined a new era of workplace culture as workers reckoned with their relationship to the physical office and negotiated a more harmonious balance in their lives. Today, remote or hybrid work is the standard, where five days a week in the office sounds like a relic of a bygone era.

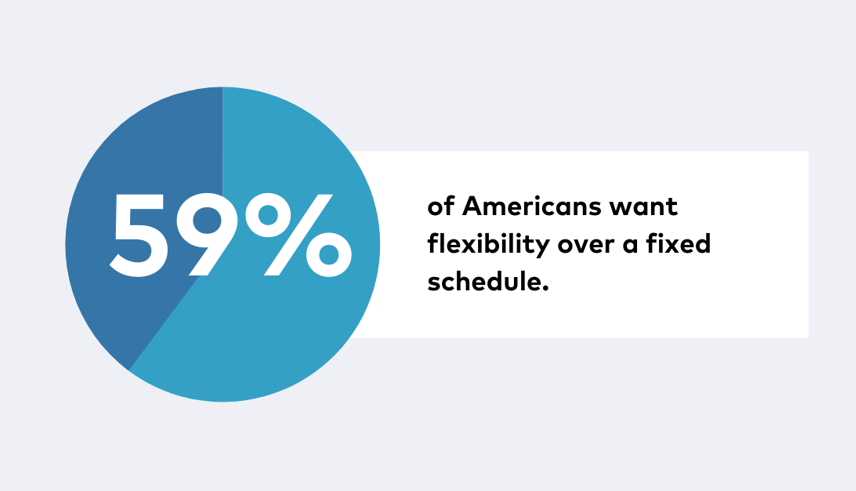

There is no going back to work the way it was before the pandemic. Now, Americans overwhelmingly want — and can often get — a schedule on their own terms. According to a Consumer Brands-Ipsos poll from March 2022, nearly six-in-10 (59%) Americans in the workforce said they want flexibility or the option to set their own hours, compared to the 39% who said they prefer a fixed, predictable schedule. Similarly, 59% said they want to work remotely, while 37% expressed wanting to work in a physical location. While a high salary is also important — 43% of respondents indicated as much — more people in the workforce (55%) said they want a high quality of life.

There is no going back to work the way it was before the pandemic. Now, Americans overwhelmingly want — and can often get — a schedule on their own terms. According to a Consumer Brands-Ipsos poll from March 2022, nearly six-in-10 (59%) Americans in the workforce said they want flexibility or the option to set their own hours, compared to the 39% who said they prefer a fixed, predictable schedule. Similarly, 59% said they want to work remotely, while 37% expressed wanting to work in a physical location. While a high salary is also important — 43% of respondents indicated as much — more people in the workforce (55%) said they want a high quality of life.

Blue Collar Work on the Edge of Revolution?

The reality is more complicated for blue collar workers — many of whom did not have the ability to work remotely during the worst waves of the pandemic. After two years of watching white collar jobs reshape, blue collar workers are looking for a version of flexibility and are poised for their own revolution, even if what it looks like has yet to come into focus.

“Flexibility is the new currency.”

Companies will have to anticipate and adapt or risk their workforce heading for the door as the values blue collar workers share with their white collar counterparts rise to the forefront. Incoming change for blue-collar workers is less about when it will happen, but how companies will usher it in. “Flexibility is the new currency,” said one CPG executive during a recent Consumer Brands’ CEO exchange.

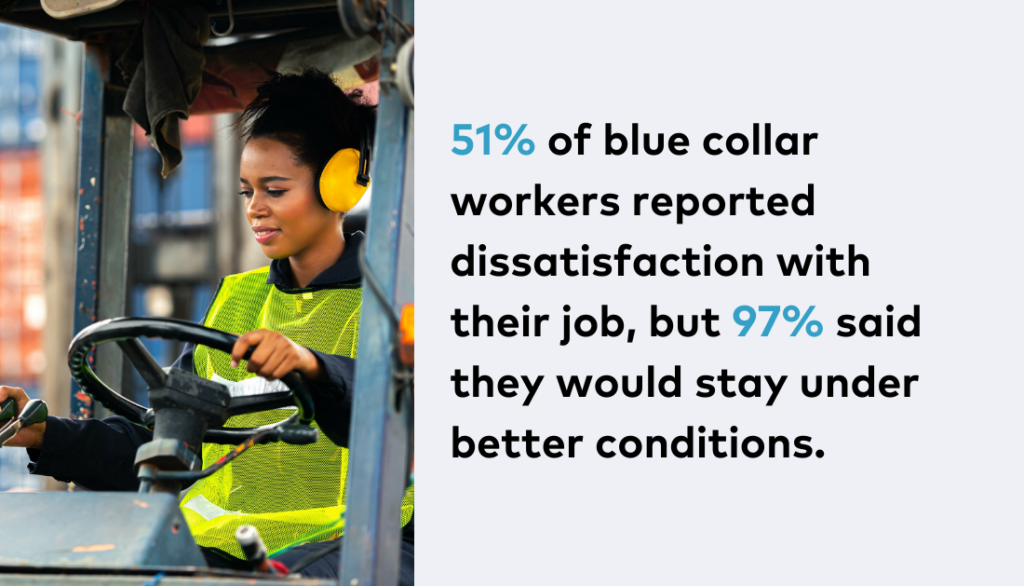

A recent study from the Oliver Wyman Forum introduced “the new collars,” — blue collar workers who transitioned to a white collar job during the pandemic — and whose “transcendence of single-collar careers is helping lead a labor revolution.” The study’s respondents represent nearly a quarter (23%) of the population and 74% of pre-COVID blue collar workers. And while more than half (51%) of blue collar workers reported being unhappy in their current roles, almost all of them (97%) said they would stay in the job if it improved to meet their salary requirements and work-life balance.

Shifting Priorities Means Shifting Business as Usual

A January study by Morning Consult of nearly 1,000 U.S. adults revealed people left their jobs because they realized their jobs can fit in their lives, not dictate it. Making more money proved a motivating factor — 38% of respondents who already left a job cited it as a major reason, as did 44% of those wanting to leave a job. But for those already out of their former workplace, their wellbeing was the frontrunner. Nearly four-in-10 (39%) respondents said leaving a toxic or hostile work environment was a major reason they quit. As for those considering changing roles, 43% said their desire for a better work-life balance was a major reason.

Many Americans who left the workforce during the pandemic have yet to find their way back — or even consider it yet. The low unemployment rate of 3.6% obscures a challenged labor force participation rate, the latter of which shows millions of Americans who have yet to reenter the labor market. What will bring them back — if anything — is the million-dollar question.

“There is far too much potential sitting on the sidelines right now,” said Joseph Aquilina, workforce issues lead and associate general counsel at Consumer Brands. “Now is a moment of workplace reinvention where we can design roles that would support these Americans returning to work — but we must first better understand their expectations and what support looks like.”

A February survey by the Manufacturing Institute also explored why Americans were leaving jobs and found that 82% of the 3,000 respondents surveyed said they retired from their manufacturing job. Less than two-in-10 (18%) lost their job or quit, and of that group, nearly three quarters (73%) got a new job in manufacturing.

“There is far too much potential sitting on the sidelines right now.”

But for those who may still be seeking employment or could be convinced to come back to the industry, MI highlights the ways companies could attract talent, including offering more opportunities to move up in manufacturing jobs, hiring people to work in locations closer to home or shifting their hours to better accommodate commuting and implementing or expanding childcare options.

The Uberization of Manufacturing

With flexibility ranking so high among workers of all collars, the “uberization” of manufacturing may be ready for its moment. These gig economy jobs give workers the ability to set their own schedules and work as much or as little as they want. Amazon has started to embrace this model with Amazon Anytime Shifts for roles in their grocery and fulfillment center warehouses, among other hourly positions.

Companies willing to take the risk may find they have a larger talent pool available to them. The CPG industry added only 4,294 jobs last month — a far cry short of the 120,000 openings the industry has.

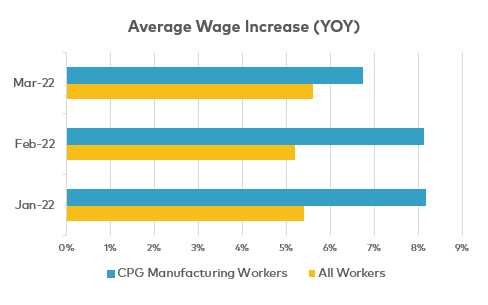

These openings have persisted despite wage increases for manufacturing workers that have outpaced overall gains. Industry manufacturing employees earn 6.7% more than a year ago, more than the 5.6% overall increase. Compared to 2019, industry companies invested $5.3 billion more into payroll (inclusive of wages and benefits) in 2020, the most recent year data is available.

These openings have persisted despite wage increases for manufacturing workers that have outpaced overall gains. Industry manufacturing employees earn 6.7% more than a year ago, more than the 5.6% overall increase. Compared to 2019, industry companies invested $5.3 billion more into payroll (inclusive of wages and benefits) in 2020, the most recent year data is available.

A recent Consumer Brands supply chain exchange, which featured discussion of supply chain leaders from CPG companies, reinforced the challenge. Participants expressed that they could not recruit new employees to night or weekend shifts. Others said that their employees wanted to be at home more and even traditional daytime shifts were being changed to allow for workers to get their children off the bus.

“There isn’t a company out there that isn’t thinking about how to recruit and retain its workforce,” said Aquilina. “Make no mistake, this is a big jump for manufacturing that would upend long-held production models, but this is an industry that jumps for the consumers it serves and asks, ‘How high?’”

#3: Sustainability

Business commitments to sustainability in concert with dire warnings on climate change and investor pressure will accelerate environmental progress — but that progress will be mired if governments conflict or misunderstand the issues.

Earlier this year, the United Nations Climate Change report offered the world its most dire warnings yet, underscoring the devastating realities of further environmental degradation and the unnegotiable need for immediate action. The CPG industry is at the forefront of that action. A Consumer Brands analysis found that among 50 top CPG companies, all of them had clear commitments to address climate change, improve packaging sustainability and reduce water usage.

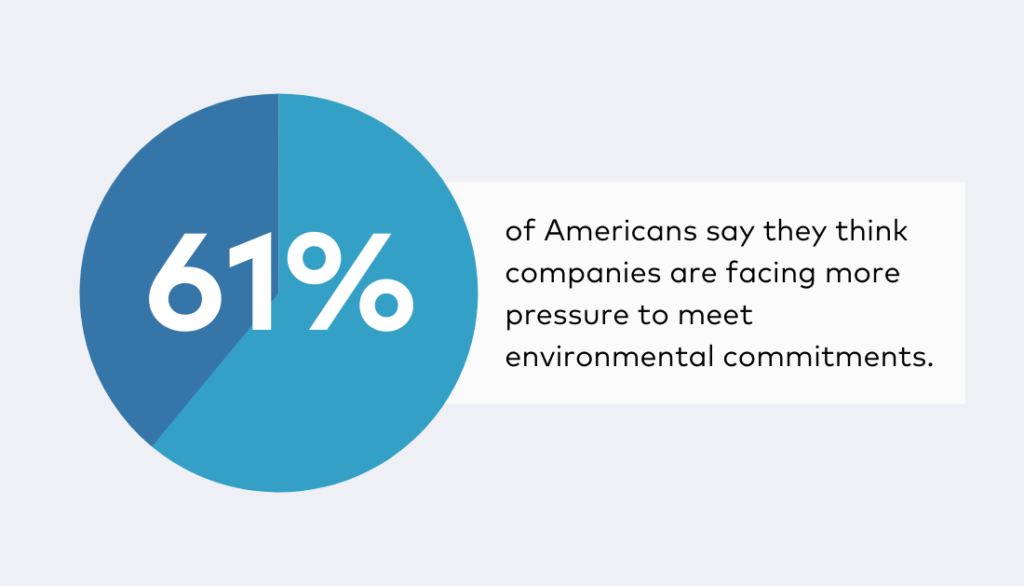

Implementation of these commitments is increasing. More than six-in-ten (61%) Americans feel that there is more pressure on companies to meet their environmental commitments today than in recent years. There is little difference between political parties on this point, with 65% of Republicans and 61% of Democrats in agreement.

Implementation of these commitments is increasing. More than six-in-ten (61%) Americans feel that there is more pressure on companies to meet their environmental commitments today than in recent years. There is little difference between political parties on this point, with 65% of Republicans and 61% of Democrats in agreement.

Consumers’ have grown increasingly worried about the state of the planet. When Consumer Brands first polled consumers in April 2019, 74% expressed concern over the environment. By November 2021, that number had jumped to 80%, with another 84% specifically concerned about plastic and packaging waste.

“A company’s success and sustainability are inextricably linked.”

Consumers’ concerns have also hit the investor community, which has sharpened its focus on corporate sustainability metrics. That focus is being amplified given a proposed SEC rule released in March that would require publicly traded companies to disclose to investors climate metrics including targets and goals, greenhouse gas emissions, “climate-related risks” impact on business and operations, and the mitigation efforts being deployed. If codified, the rule would impose new reporting duties creating reputational risk, new accountability measures and shifts with a variety of stakeholders. The bottom-line specifics create a new imperative for companies to view their sustainability commitments as not a goal but a scorecard.

“A company’s success and sustainability are inextricably linked,” said Consumer Brands’ Vice President of Packaging Sustainability John Hewitt. “CPG companies are leading on sustainability and appreciate that investors and others are seeking more information on how companies are driving environmental change.”

Seeing Green (With an Environmental Blind Spot)

One of the biggest roadblocks companies will face in meeting their packaging sustainability commitments is recycled content targets. As technology improves and enables more recycled content to be used — particularly in food packaging that has more stringent requirements from FDA — the demand for post-consumer material has swelled. The market, however, has not.

The domestic supply of recycled plastics is only able to meet six percent of current demand. David Cornell, the former technical director for the Association of Plastic Recyclers, estimated that to meet future demand, the U.S. recycling rate for PET containers will need to jump to at least 70 percent — it’s not even close to halfway there today. In fact, it’s declining. From the peak of 35% in 2017, the national recycling rate has dropped to 32%. For plastic, the situation is even worse, with only 8% recycled.

The domestic supply of recycled plastics is only able to meet six percent of current demand. David Cornell, the former technical director for the Association of Plastic Recyclers, estimated that to meet future demand, the U.S. recycling rate for PET containers will need to jump to at least 70 percent — it’s not even close to halfway there today. In fact, it’s declining. From the peak of 35% in 2017, the national recycling rate has dropped to 32%. For plastic, the situation is even worse, with only 8% recycled.

The culprit behind America’s low recycling rate is a broken system. In the U.S., nearly 10,000 local recycling programs set their own rules of what can and can’t be recycled, resulting in a patchwork that confuses and deters consumers. In Fairfax County, Va., for example, there are 13 private companies that handle residential pickup in addition to the county itself, which collects from only about 10% of residents. To determine what can be recycled, the county can only offer general guidelines, telling residents with private collection to ask the company responsible for their pickup for specifics. That leaves 14 possibilities within one county.

A Consumer Brands/Ipsos poll found that 71% of Americans feel the sheer number of systems creates confusion and 65% believe that recycling rules should be the same nationwide.

Investing in Recycling’s Environmental Potential

The potential of a functioning recycling system is enormous. The Tellus Institute found that significantly boosting the recycling rate has the potential to add 2.3 million jobs and reduce carbon emissions by nearly 515 million metric tons — equivalent to taking 50 million cars off the road.

Also enormous? The cost to fix America’s broken recycling system. The CPG industry is well aware it will take significant funding to achieve a functioning system and move close to a circular economy. And it stands ready to financially support making the system work. There are a variety of funding approaches that can be considered, though extended producer responsibility (EPR) has gained the most attention in the states in recent years.

Consumer Brands supports EPR and the accountability it requires of stakeholders across the packaging value chain to both understand and accept their contribution to the issues facing recycling in the U.S. and set tangible goals. The industry’s support is based on principles that ensure funding is dedicated, targeted and impactful.

“Throwing money at the problem doesn’t solve it, it only raises the cost of failure,” said Hewitt. “We need to develop uniform standards for recycling that allow us to make smart, data-driven decisions that direct smart investments and secure the system’s future.”

The Foundation That is Missing

Getting the data to make smart decisions is near impossible today. But establishing standardized definitions could eliminate the guesswork of what is recyclable in the morass of 10,000 systems and unlock the gateway to fixing the broken system.

“It is impossible to overstate how important standardization and reliable data are to fixing America’s broken recycling system.”

Standardization of recycling definitions and rules would create a foundation of comparable data that will drive needs assessments that pinpoint areas to fix, practices to emulate and how to invest wisely. It would be the intelligence that drives better designed packaging, smart upgrades to infrastructure and technology and consistent consumer education to reduce contamination and increase properly recycled material.

“It is impossible to overstate how important standardization and reliable data are to fixing America’s broken recycling system. They are the foundation that recycling needs; we are otherwise building our house on sand,” said Hewitt.

Conclusion

After two years of unexpected, seismic change any looking ahead is done tentatively. America is emerging from the shadow of COVID-19 with a fundamentally different perspective that will inform everything that comes next — as is the CPG industry.

The industry has been tested at every turn and answered every challenge with determination and innovation. It has delivered for consumers in the highest demand environment it has every experienced. And it continues to do so, every day.

Read More

Blog

The Defendant Strikes Back: A Strategy for Managing Nationwide Class Action Risk

Blog

Proud of Our Industry’s Workforce and Dedication to America – Today and Every Day